Understanding Telegram USD (tgUSD) Token: Your Guide to Stablecoin on TON

Torch Finance created Telegram USD with a clear vision: to be a cross-chain stablecoin that's specifically designed for TON and Telegram.

Stablecoins on Telegram

Before we jump into tgUSD, let's talk about stablecoins in general, especially when it comes to a platform as massive as Telegram.

Imagine trying to pay for your coffee with Bitcoin or Toncoin every day. The price swings of these cryptocurrencies can be pretty wild, right? One day, your crypto might buy you two coffees; the next day, only half a coffee. This is where stablecoins come in!

Stablecoins are like the “digital dollars” (or other stable currencies) of the crypto world. They are designed to maintain a stable value, usually by being pegged 1:1 to a traditional currency like the US dollar. This means 1 stablecoin should always be worth roughly $1.

Why is this a game-changer for Telegram?

- Seamless payments: Stablecoins make it super easy to send and receive value without worrying about price fluctuations. Think about sending money to a friend across the globe, instantly, and with minimal fees, directly within your chat app!

- DeFi opportunities: Stablecoins are the backbone of decentralized finance (DeFi). They allow users to lend, borrow, and earn yield on their digital assets in a predictable way.

- Accessibility: With stablecoins integrated into Telegram's popular Wallet, millions of users who might be new to crypto can access digital assets in a user-friendly and familiar environment.

The biggest player in this space on TON right now is USDT (Tether) on TON, which has seen incredible adoption and allows for direct, low-fee transactions within Telegram's native wallet. But the TON ecosystem is dynamic, and new innovations are always emerging, like tgUSD.

Enter tgUSD: Creation and Purpose

So, while USDT is the widely used stablecoin, tgUSD token is a distinct stablecoin project building its own niche within the TON blockchain. It's not directly issued by Telegram itself, but rather by Torch Finance, a liquidity protocol within the TON ecosystem.

The Purpose of tgUSD

Torch Finance created Telegram USD with a clear vision: to be a cross-chain stablecoin that's specifically designed for TON and Telegram. Think of it as a specialized tool for enhancing DeFi activities and payments within the Telegram universe. Its core goals include:

- Cross-chain yield: tgUSD aims to enable users to earn profits by leveraging liquidity across different blockchain networks. This means you could potentially use your tgUSD coin to earn rewards not just on TON, but eventually on other chains like Ethereum and Solana.

- Seamless payments: Just like other stablecoins, tgUSD wants to facilitate easy and efficient payments, especially for mini-applications and payment solutions built directly within Telegram.

- Optimized for DeFi: Torch Finance is positioning tgUSD as a go-to asset for decentralized finance protocols on TON, offering a stable base for lending, borrowing, and other yield-generating activities.

Who Created tgUSD?

The tgUSD token was created and launched by Torch Finance in May 2025. They are a liquidity protocol that is actively building and expanding its offerings within The Open Network (TON). Torch Finance's goal is to become a key player in the TON DeFi landscape, and tgUSD is a central component of that strategy. They aim to provide users with a stable, yield-generating asset that integrates smoothly with the Telegram ecosystem.

Telegram USD (tgUSD) Tokenomics (How it Works)

1:1 Backing: The fundamental principle of tgUSD is that it aims to be pegged 1:1 to the US dollar. This means for every 1 tgUSD coin in circulation, there should be $1 worth of collateral held in reserve.

Collateral: Currently, tgUSD is primarily backed by USDT (Tether). This means that when you mint (create) tgUSD, you are likely providing USDT as collateral. Torch Finance has stated plans to expand this backing to include other major stablecoins like USDC and potentially USDe in the future. This diversification could add more robustness to its peg.

Yield Generation: A key feature of tgUSD is its ability to generate yield. Users can stake their tgUSD to earn additional profits. Torch Finance achieves this by strategically leveraging the collateral across various cross-chain liquidity pools, optimizing capital efficiency. This means your tgUSD isn't just sitting idle; it's actively working to earn you returns.

Roadmap for Expansion: Torch Finance has a clear roadmap for tgUSD:

- Phase 1 (Completed): Integration with USDT as collateral.

- Phase 2 (Q2/2025): Plans to add USDC and USDe as additional collateral options, which could further strengthen its stability and appeal.

- Phase 3 (Future): Ambitious plans to expand tgUSD's reach to other major blockchain ecosystems like Ethereum and Solana, making it a truly cross-chain stablecoin.

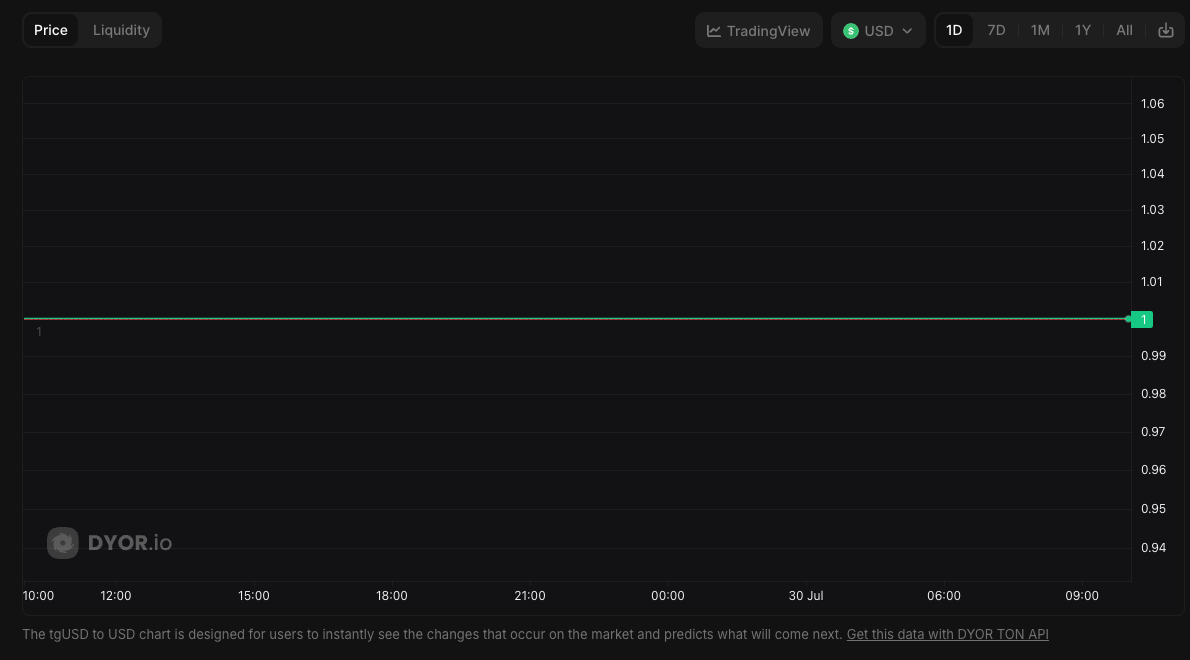

What is a tgUSD Price?

Since tgUSD is a stablecoin designed to maintain a 1:1 peg with the US dollar, its tgUSD price should ideally remain very close to $1. You won't see the dramatic price swings that you might with Toncoin or other volatile cryptocurrencies.

However, it's crucial to understand that even stablecoins can sometimes experience slight deviations from their peg, especially during periods of high market volatility or if there are concerns about the collateral backing them. These deviations are usually temporary and small, but it's something to be aware of.

Conclusion

As you can see, the world of stablecoins on TON, including tgUSD token, offers exciting possibilities. However, with any investment or digital asset, the golden rule of crypto applies: Do Your Own Research (DYOR)!

Before you make any decisions about acquiring or using tgUSD (or any other token, for that matter), it's vital to:

- Understand the project: Dig deeper into Torch Finance, their team, and their long-term vision.

- Review audits: Look for independent security audits of their smart contracts to ensure the safety of your funds.

- Check collateral transparency: Understand how transparent and verifiable the backing of tgUSD is.

- Monitor the tgUSD price: Keep an eye on its stability and how well it maintains its peg to the US dollar.

DYOR.io is your go-to platform for exactly that! We provide comprehensive analytical data and real-time information on cryptocurrency prices within the TON ecosystem. On DYOR.io, you can explore essential metrics like:

- Current price

- 24-hour trading volume

- Hourly, 6-hour, 24-hour, and weekly percentage changes

- Liquidity

- Market capitalization

- Trust Score

Ready to dive deeper? Visit DYOR.io today, get the data you need to monitor performance and make informed decisions about tokens on the TON blockchain. Your crypto journey starts with solid research, and DYOR.io is here to help you every step of the way!