Toncoin In Numbers: September Recap

In continuation of the challenging period for Toncoin in August, September turned out to be a month filled with even more significant events that influenced the state of the network and the price of $TON. After the severe blow at the end of August, September became a time of both challenges and opportunities. Despite fluctuations, the token continues to surprise — it not only recovers but also retains the community's interest. Let’s discuss in more detail the price of TON and the events of this month that affected it.

Price and Market Capitalization

September didn't start off well for Toncoin. In the first week, the market went into a dive: at the beginning of the month, the price was around $5.40, but by September 7, it had dropped to $4.75. Panic and uncertainty spread through the community — all of this weighed on the token, accelerating sell-offs. However, as you can see on the chart, Toncoin did not give up.

Starting from mid-September, Toncoin began to slowly but steadily recover. By September 15, the price had risen to $5.50, and by the end of the month, the token climbed to $5.88, at one point even surpassing the $6.00 mark. Overall, September ended on a positive note, though the price did not return to pre-crisis levels, it came quite close to those marks.

Toncoin's market capitalization reached $14.8 billion, allowing it to remain in the top 10 cryptocurrencies by capitalization. Throughout the month, many traders reconsidered their strategies, and the market remained tense, awaiting further developments.

Pavel Durov's Arrest and Its Impact on Toncoin's Price

One of the most high-profile events that affected the state of Toncoin was the arrest of Telegram founder Pavel Durov on August 24. This news instantly caused the token's price to collapse: within days, Toncoin's price plummeted by 20%, falling below $5. Panic selling and the general shock from the arrest were exacerbated by technical glitches in the TON network, further increasing market pressure.

The market is still in a state of uncertainty, but as the past months have shown, the TON ecosystem remains resilient to external shocks.

Network Activity and Airdrops

September saw the biggest airdrop of the year — Hamster Kombat ($HMSTR) — which kicked off on September 26. But not everything went according to plan: after the distribution, the token’s price crashed by 90%. Yes, it was a hard hit, but not fatal, and the Hamster Kombat team is not abandoning the project. They have already introduced a new roadmap aimed at restoring the token’s economy and attracting users.

Another notable event in the network was the Catizen airdrop. You can read more about this and the project itself here.

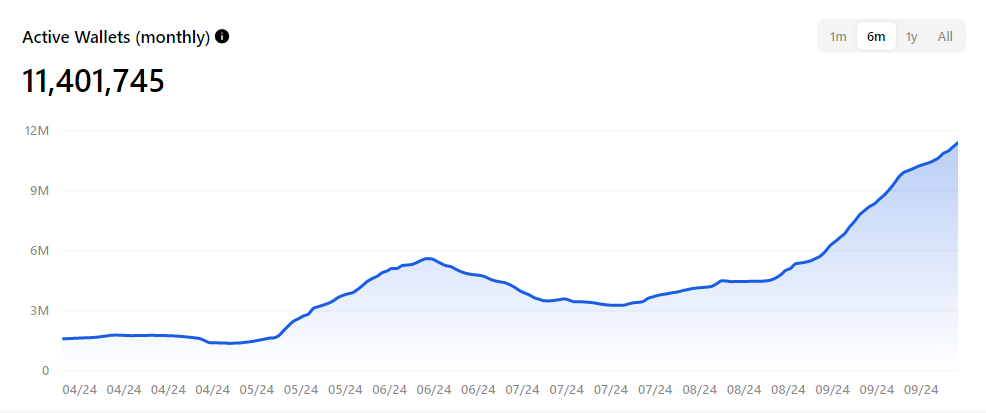

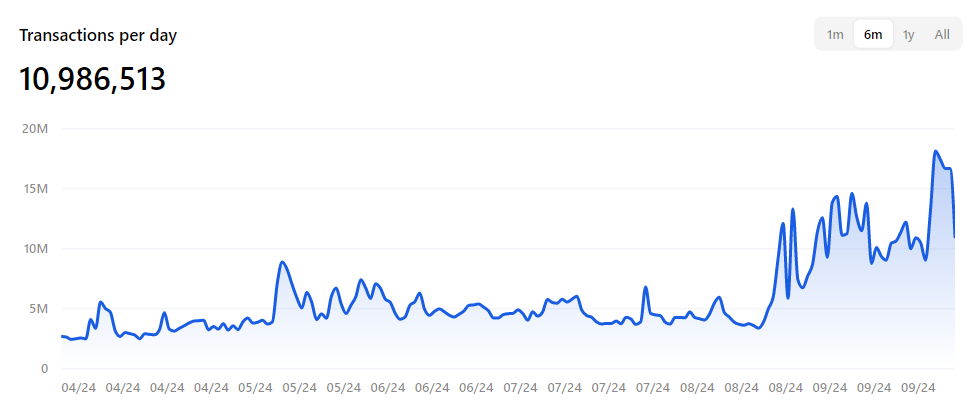

The airdrops of major projects have become one of the main reasons for the increase in active wallets (by almost 89%), and the number of transactions jumped by 78%. This shows that interest in Toncoin is not waning but is, in fact, becoming more stable.

Autumn promises to be eventful — token distributions from X Empire, Major, Blum, MemeFi, and other projects should bring even more activity to the TON ecosystem. Considering the number of upcoming airdrops, we quickly created and launched a unique product — Airdrop Checker, which allows network users to check their eligibility, the number of tokens due, and their estimated value.

Forecasts

September was a month where Toncoin literally balanced on the edge. The $6 level became a stumbling block — each time the price approached this mark, the market responded with a surge in sell-offs. However, if Toncoin manages to break through this level, the doors to $7, or even $8, could open.

But let's not forget about another scenario: if selling pressure continues to rise, the price may roll back to $4, and in the case of negative events, fall even further. It all depends on how the market reacts to events happening in the world.

Conclusion

September was truly turbulent: Pavel Durov's arrest, price swings, airdrops, and a sharp rise in network activity. This not only shook the TON ecosystem but also gave it new opportunities. The community, in turn, was once again convinced that Toncoin is not just a token but a true fighter. Even after powerful shocks, the token can slowly but steadily recover, and the ecosystem can continue to develop. Future airdrops and new partnerships could become excellent growth catalysts, but the market remains cautious.

Ahead are many challenges and opportunities, and Toncoin is ready to face them. Will it continue to grow and finally break the coveted $10 mark? Anything is possible. But one thing is certain: Toncoin doesn’t give up without a fight.