What Is EVAA Protocol? The Billion-Dollar DeFi Project on TON

EVAA Protocol is a decentralized lending and borrowing platform built on The Open Network (TON) and fully integrated into Telegram Mini Apps.

The world of decentralized finance (DeFi) is evolving fast — but few projects have managed to make crypto as accessible as EVAA Protocol, TON’s largest DeFi platform. Built directly inside Telegram, EVAA allows users to lend, borrow, and earn yield within the messaging app.

With over $1.4 billion in transactions and 300,000 wallets already connected, EVAA is not just a financial protocol — it’s the foundation of a new community-owned economy inside Telegram.

In this DYOR.io deep dive, we explore what EVAA is, how it works, who’s behind it, and why it’s shaping the future of DeFi on The Open Network (TON).

What Is EVAA Protocol?

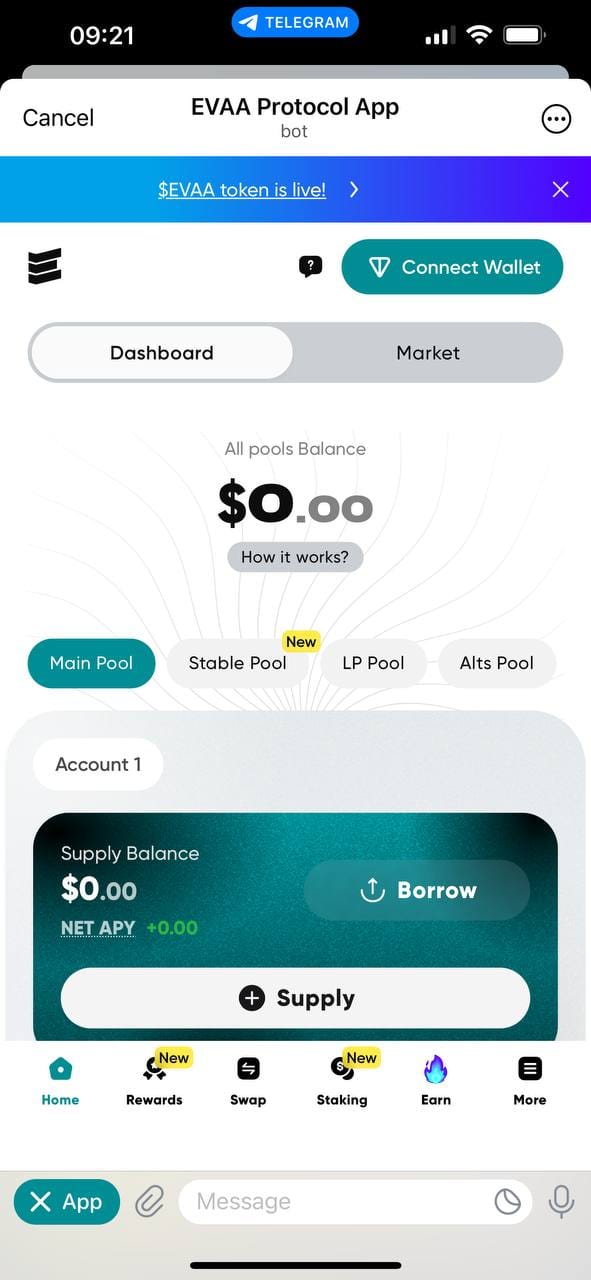

EVAA Protocol is a decentralized lending and borrowing platform built on The Open Network (TON) and fully integrated into Telegram Mini Apps.

Unlike traditional DeFi projects that require browser extensions or external wallets, EVAA enables users to manage digital assets directly within Telegram — making DeFi simple, fast, and familiar for the app’s billion-plus users.

Through EVAA, anyone can:

- Deposit assets to earn passive yield

- Borrow tokens against collateralized holdings

- Participate in governance decisions via the $EVAA token

This model bridges the gap between social apps and blockchain finance, enabling users to access DeFi tools directly within Telegram.

In short: EVAA brings decentralized banking to your chat window.

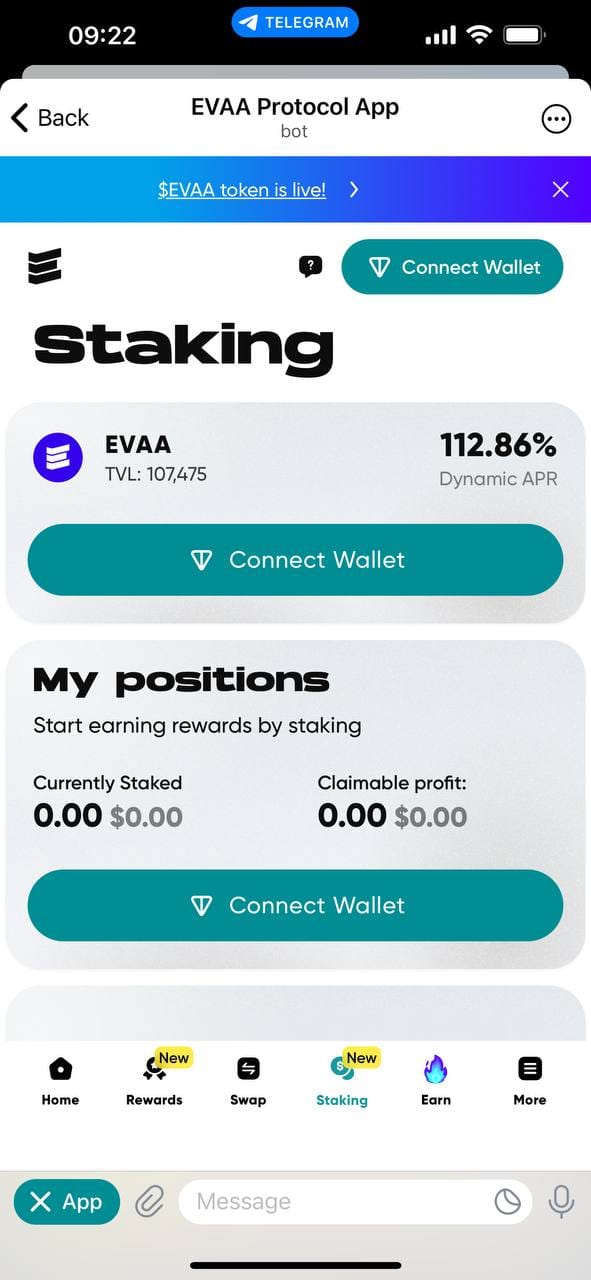

EVAA Protocol dApp

From Hackathon Idea to Billion-Dollar Ecosystem

EVAA’s journey began at the 2023 Hack-a-TON x DoraHacks event. The project’s co-founder, Alexander Sudeykin, introduced one of TON’s earliest lending apps — with a vision to make DeFi accessible to everyone on Telegram.

What started as a hackathon prototype quickly scaled into TON’s largest DeFi protocol, processing $1.4 billion in transactions and connecting over 300,000 wallets within its first growth cycle.

The success proved a key point:

When DeFi meets the right user experience, adoption follows naturally.

What Telegram Gives EVAA

Most DeFi platforms still depend on complex dashboards and third-party wallets that intimidate new users. EVAA changed that by embedding the entire process inside Telegram — the app that people already use daily for messaging, business, and communities.

Through the EvaaAppBot, users can:

- Connect their TON wallet instantly

- Deposit crypto to earn yield

- Borrow stablecoins or assets

- Track balances and positions — all within Telegram’s familiar chat interface

This Telegram-native approach gives EVAA a massive advantage:

- It lowers barriers for mainstream users

- It creates a frictionless DeFi experience

- It merges social interactions with financial actions

No other blockchain has achieved this level of integration yet — and that’s why EVAA is being called the “liquidity layer for Telegram.”

The $EVAA Token: Powering A Community-Owned Protocol

At the center of EVAA’s ecosystem is its native token, EVAA coin, which transforms users from passive participants into active stakeholders.

The $EVAA token isn’t just for trading or staking — it’s a governance and ownership instrument that allows the community to shape EVAA’s direction.

1. Governance Rights

Holders of the $EVAA token have a direct say in the protocol’s evolution. They can take part in decisions that shape the platform — from adjusting lending limits and adding new collateral options to setting fee structures and allocating treasury funds for development.

All major updates are decided through transparent, on-chain community voting, ensuring the project’s direction reflects its users’ collective voice.

2. Revenue Sharing

Part of the fees collected by the protocol is allocated to a buyback and burn program. This mechanism gradually decreases the total number of $EVAA tokens in circulation, which can strengthen the token value and reward those who hold it long term.

3. Enhanced Yields

Community members who stake their $EVAA tokens or contribute liquidity to the platform can earn higher returns on their assets. This incentive model motivates active participation and helps grow the overall health of the EVAA ecosystem.

4. Fee Discounts

Active users holding $EVAA enjoy lower borrowing and liquidation fees, improving cost efficiency.

Together, these mechanics make the EVAA token function like shares in TON’s DeFi infrastructure, aligning user incentives with platform growth.

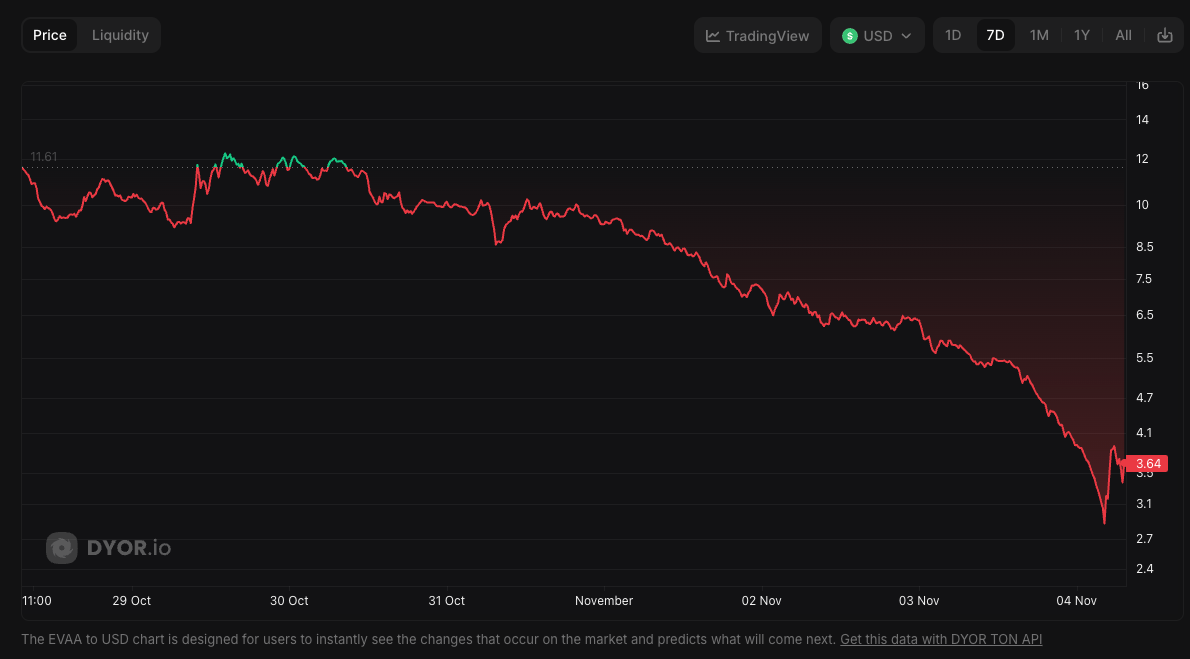

$EVAA Token Price and Where to Get It

As of today, the 2nd of November, the EVAA TON token price is $3,64. The EVAA Protocol token market capitalization is $ 121.59 M.

The token is available on several major exchanges, making it easy for global users to join the ecosystem:

- Binance Alpha

- MEXC

- STON.fi

- Gate.io

The token works on both the TON and BNB Chain networks, thanks to Symbiosis Finance, which handles the bridge between them. Cross-chain security is maintained by trusted validators, such as Binance Labs and P2P.org, allowing users to easily transfer tokens without worrying about complicated technical steps.

EVAA’s Future Plans: Building a Complete DeFi Experience

EVAA’s long-term goal goes far beyond simple lending and borrowing. The project is building a complete financial layer inside Telegram, where people can earn, borrow, and also use their crypto in everyday life.

What’s Next?

1. Card Payments

EVAA is working on launching crypto payment cards that will let users spend the income they earn from DeFi directly through regular payment systems — all without leaving Telegram. This update will connect on-chain profits to real-world spending.

2. Smarter Borrowing Options

The team also plans to introduce under-collateralized loans, which use Telegram’s social reputation features to assess trust. This means active or verified users could borrow funds with less collateral, making credit more flexible and efficient.

3. Better Yield Opportunities

EVAA is developing advanced yield tools, including automated yield loops and liquid staking options, to help users maximize the value of their assets while keeping capital usage efficient.

“Our goal is to make Telegram a place where earning, borrowing, and spending all happen seamlessly,”

says Vlad Kamyshov, CEO of EVAA.

This mission fits perfectly with TON’s broader vision — turning Web3 finance into something as easy and natural as sending a Telegram message.

The DAO Transition: From Project to Community Ownership

EVAA is moving toward full community control by becoming a Decentralized Autonomous Organization (DAO), managed through the AvatarTON Foundation.

This new structure means that decisions about the platform, including its growth, income use, and new features, are made collectively by the community, not just the founding team.

The EVAA DAO is built on four key principles:

- Transparency: Every proposal and vote happens directly on-chain for anyone to see.

- Participation: $EVAA token holders have the power to shape the platform’s direction.

- Sustainability: A portion of revenue is reinvested into the ecosystem through buybacks and community rewards.

- Innovation: Developers can suggest and build new tools or features under the EVAA framework.

With DAO governance now active, EVAA is transforming from a traditional startup into a self-sustaining financial system owned and operated by its users.

How To Get Started With EVAA

Getting started with EVAA is straightforward, even for beginners in DeFi.

- Open Telegram and go to EvaaAppBot.

- Connect your TON wallet (such as TON Space or Tonkeeper).

- Deposit crypto assets to earn interest or use as collateral.

- Borrow or lend directly from your Telegram chat.

- Stake $EVAA to earn boosted rewards and participate in DAO voting.

That’s it — no extensions, no complicated signups.

For those exploring the TON ecosystem, EVAA is the easiest on-ramp into decentralized finance.

Risks and Things To Consider

Like any DeFi platform, EVAA carries certain risks that users should be aware of before participating. DYOR.io encourages everyone to do their own research before investing.

- Smart contract risk: Despite audits, vulnerabilities can still exist.

- Market volatility: TON and EVAA tokens can fluctuate significantly in value.

- Token unlocks: As more tokens enter circulation, price impact is possible.

- Regulatory risks: DeFi lending products may face evolving legal scrutiny.

- Social lending risks: Undercollateralized loans based on reputation are still experimental.

Always analyze data from multiple reliable sources, understand the mechanics, and never invest more than you can afford to lose.

Final Thoughts: DYOR Before You Dive In

EVAA Protocol is more than a DeFi app — it’s an experiment in decentralized, user-owned finance at scale. It combines the best of TON’s technology with Telegram’s massive reach to make crypto truly social and accessible.

However, as with all blockchain projects, research is key. Before investing, lending, or staking, always DYOR — Do Your Own Research.