DEX Insights: How to make the most out of TON with bridges

Blockchain Ecosystems and Decentralized Exchanges (DEX) continue to grow, providing users with ever more opportunities. Transactions without intermediaries, control over assets - all of this sounds enticing. But to have access to it all, you need to know about bridges. These bridges connect different networks, allowing tokens and other assets to be transferred back and forth. This is especially relevant in TON: with bridges and DEX, you not only manage your assets, but do so efficiently, with favorable rates and minimal fees.

In this article, we'll dive into how to work with DEX and bridges and figure out how to make the most out of them. At the same time, we'll explore the features available to users on DYOR.io and swap.coffee.

What is a DEX (Decentralized Exchange)?

Decentralized exchanges, or DEX, are platforms where you can trade cryptocurrency without any intermediaries. Unlike centralized exchanges (CEX), where everything is controlled by admins and central organizations, DEX operate on smart contracts. Everything is automatic, precise, and transparent - no human factor involved, which means greater security.

What makes DEX so good?

- No intermediaries

Transactions happen directly between users. Forget about the fees that centralized exchanges usually take or the risks of someone freezing your assets.

- Full control over assets

Your money remains yours - no one touches it, stores it, or blocks it.

- Security and privacy

Data and asset protection is at a high level because DEX aren't dependent on centralized servers, which can be hacked or leaked.

- Accessible to everyone

No matter where you are - there’s no tie to any specific country or jurisdiction with DEX. You can trade peacefully even from the other side of the planet.

In TON, DEX is not just a tool for trading but a way to manage tokens without needing to trust centralized structures. This is especially relevant in the context of the growing interest in decentralized finance (DeFi), where trust and security play a key role.

Bridges: How Do They Work and Why Are They Needed?

Bridges are essential if you want to transfer assets between different blockchains. Each blockchain has its own rules, tokens, and smart contracts. Without bridges, interaction between networks like TON, Ethereum, or Binance Smart Chain would be very difficult. Bridges break down these barriers, allowing assets to be transferred from one network to another, like a railway system.

How does it work?

Bridges work on a simple but brilliant principle: locking here - creating there. Here’s what happens:

- Asset Locking

When you want to transfer tokens from network A to network B, assets in network A are locked by a special smart contract. This contract "holds" your tokens and guarantees they won’t go anywhere.

- Token Creation in Another Network

After assets are locked in network A, "wrapped" tokens, equivalent to the locked ones, are created in network B. For example, when transferring TON from TON to Ethereum, wrapped TON tokens appear in Ethereum and can be used just like any other tokens in that network.

- Returning Assets

If you need to return assets back to network A, simply send the wrapped tokens back through the bridge. The smart contract in network B "burns" them, and your original tokens in network A are "unlocked" and returned to you.

Technologies Ensuring Security

Bridges are built on decentralized technologies, but asset locking alone isn’t enough for security. Several key technologies ensure that exchanges are truly reliable:

- Smart Contracts

These are automated programs that handle all the hard work: monitoring asset locking, fulfilling transaction conditions, and returning assets if something goes wrong. Smart contracts act as the trusted party between blockchains.

- Oracles

Oracles act as the go-betweens for networks. They verify information to ensure that assets in one network correspond to assets in another. They minimize the risk of errors or false data.

- Multisig

To enhance security, some bridges use multisignatures (multisig), meaning several parties must agree for a transaction to go through. This makes hacking almost impossible.

The Role of Bridges in the TON Ecosystem

Bridges are gateways to new opportunities for TON users. They provide access to other blockchains and DeFi platforms. With bridges, you can send tokens between ecosystems like Ethereum and Binance Smart Chain. This not only opens doors to new markets and projects but also allows participation in liquidity farming, token sales, and other DeFi activities.

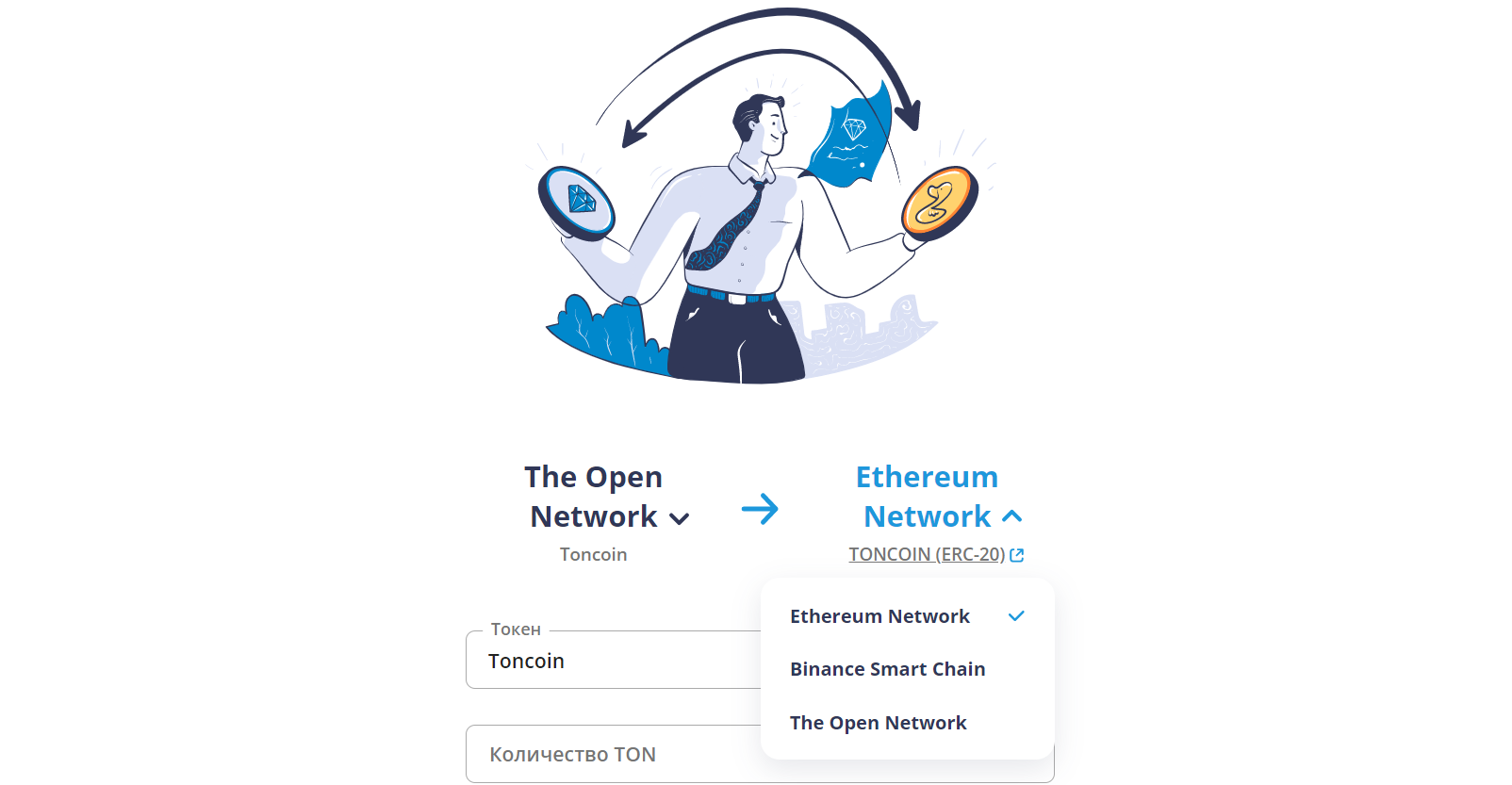

TONBridge

TON Bridge is one such bridge that connects TON with Ethereum and Binance Smart Chain. With it, users can transfer their TON tokens between networks, use them in various DeFi projects, and return them with minimal fees. For example, you can transfer your tokens to Ethereum, participate in farming there, and then bring them back to TON.

Opportunities of Bridges and the Benefits of DEX Aggregators for TON Users

One of the main benefits of using bridges and DEX aggregators in TON is access to a vast sea of assets and the ability to trade them freely across different blockchains. DEX aggregators act like your personal assistants, gathering information from multiple exchanges to help you find deals where the commission is the lowest and the rate is the best.

Why Are Bridges So Cool?

- Cross-chain liquidity

Bridges are your tickets to several markets at once. Move assets from TON to Ethereum or back, find new trading pairs, and liquidity pools. It’s like being on multiple exchanges at once, but more convenient.

- Endless staking and farming opportunities

With bridges, your TON tokens become a universal key to earnings in other networks. You can participate in farming and staking on another blockchain while continuing to develop assets in TON. You benefit from both sides at once.

- Increased profitability

Thanks to bridges, you can catch the best interest rates for staking or farming, as each blockchain offers its own conditions. Bridges help move assets where profits are higher, making your money work more efficiently.

Why Do We Need DEX Aggregators?

DEX aggregators are services that do all the dirty work for you. They monitor rates and fees across different exchanges and gather this data in one place. This means you don’t have to search manually for the best conditions - the aggregator shows you where to make the most profitable trade. This is especially important for active traders who don’t want to overpay in fees or lose out on rate differences.

Key Advantages of DEX Aggregators

- Best exchange rates

DEX aggregators constantly monitor offers from various exchanges and give you the best rate. It’s like having a personal assistant who finds where things are cheaper. Traders save money and get more tokens for their assets - what could be better?

- Savings on fees

Some aggregators are so smart that they split a transaction into several parts to minimize fees. This is especially important if you’re dealing with large volumes - why overpay when you can cut costs?

- Increased liquidity

Aggregators also help increase market liquidity by providing access to various pools across multiple platforms. This reduces slippage risk, especially for large transactions. For those handling large positions, this is a real find.

Why Is This Important for TON Users?

TON already integrates different DEX aggregators that help find the best conditions for transactions. For example, aggregators can pull data from platforms like STON.fi or DeDust, showing where liquidity pools and the lowest fees are. For you, this means one thing: always being in a winning position.

Using bridges together with DEX aggregators is a true hack for maximizing your deals. Bridges transfer assets, aggregators find the best conditions, and you trade and invest with maximum profit. Move assets between networks, find the best deals, and earn through staking or farming in different ecosystems - all without the extra hassle.

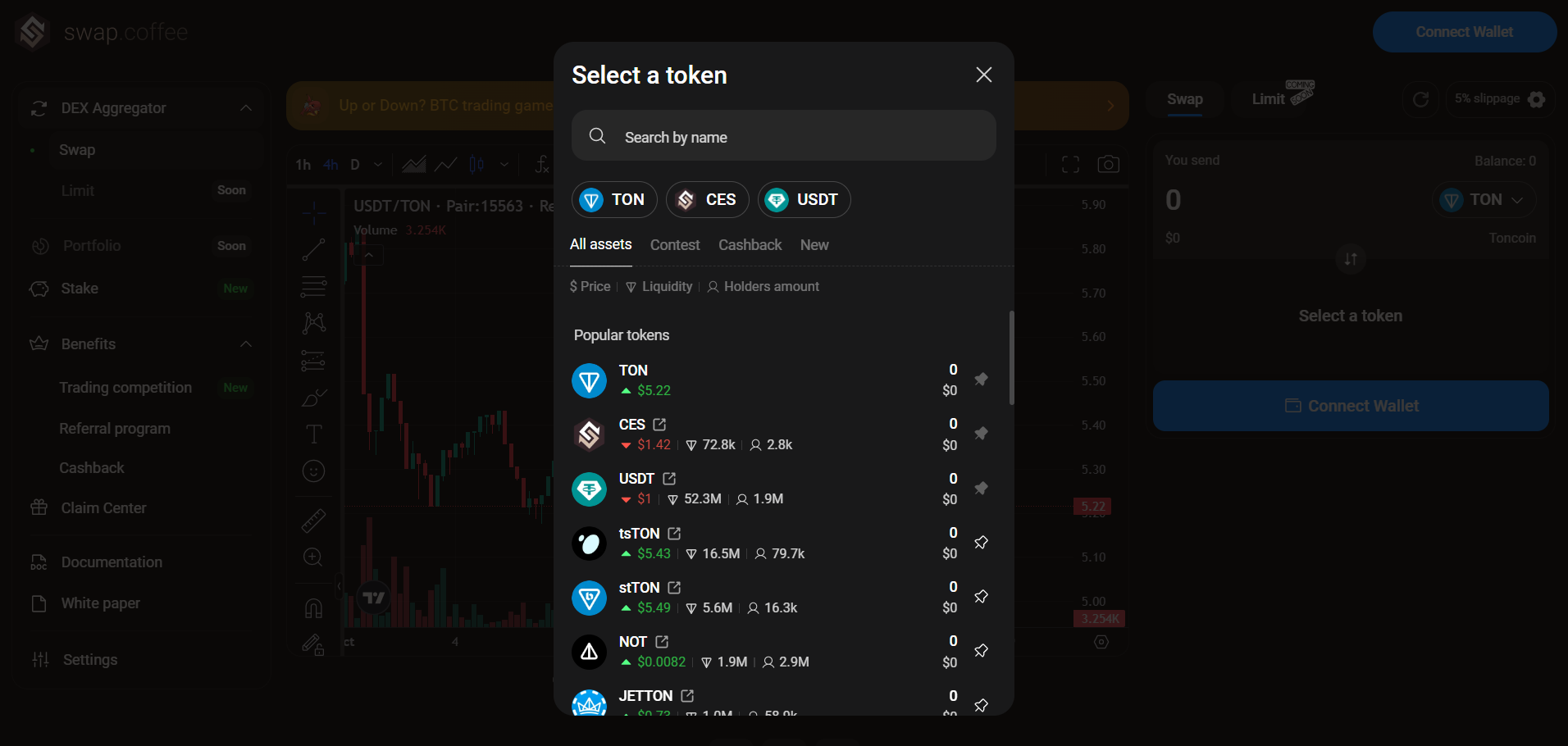

swap.coffee: What Is It and How to Use It?

swap.coffee is a platform that turns the approach to over-the-counter (OTC) cryptocurrency deals upside down. Everything is built on blockchain and smart contracts, ensuring full transparency and security of transactions. And these aren’t just words - the presale in June 2024 raised 200,000 TON (around $1,180,000) in just two days! This result speaks for itself: users are actively seeking solutions like swap.coffee.

What Makes swap.coffee Special?

- Transparency of transactions

Smart contracts automatically enforce terms, eliminating any human errors or risks. Everything is clean and transparent - transactions run like clockwork.

- No intermediaries

There are no third parties here. All deals are directly between participants. This not only lowers costs but also eliminates middlemen who usually take a commission.

- User control

You decide how, when, and with which assets to work. Full flexibility - if you want to swap one asset for another, set your conditions, and everything will be done as you need.

- Simple interface

Designed for everyone - from beginners to OTC veterans. No complicated settings or unclear features. Everything is intuitive and quick.

- Staking system

Each transaction generates a commission in Swap tokens, which is then distributed among stakers. This not only keeps interest in the platform alive but also rewards long-term token holders.

- Limited issuance

The number of Swap tokens is strictly limited, helping avoid inflation and maintain their value. This is especially important for active platform users.

How Does It Work?

swap.coffee supports several operating modes:

- Within one network

It's simple - create an order through the interface, the smart contract executes the deal, and assets move. If something goes wrong, assets are returned to the owner.

- Between networks (without bridges)

Here, oracles come into play. They transmit information between networks, while smart contracts lock assets in one network and create their equivalents in another.

- With bridges

Bridges facilitate asset transfer between blockchains. Oracles monitor the correctness of transactions, reducing risks and making the process reliable.

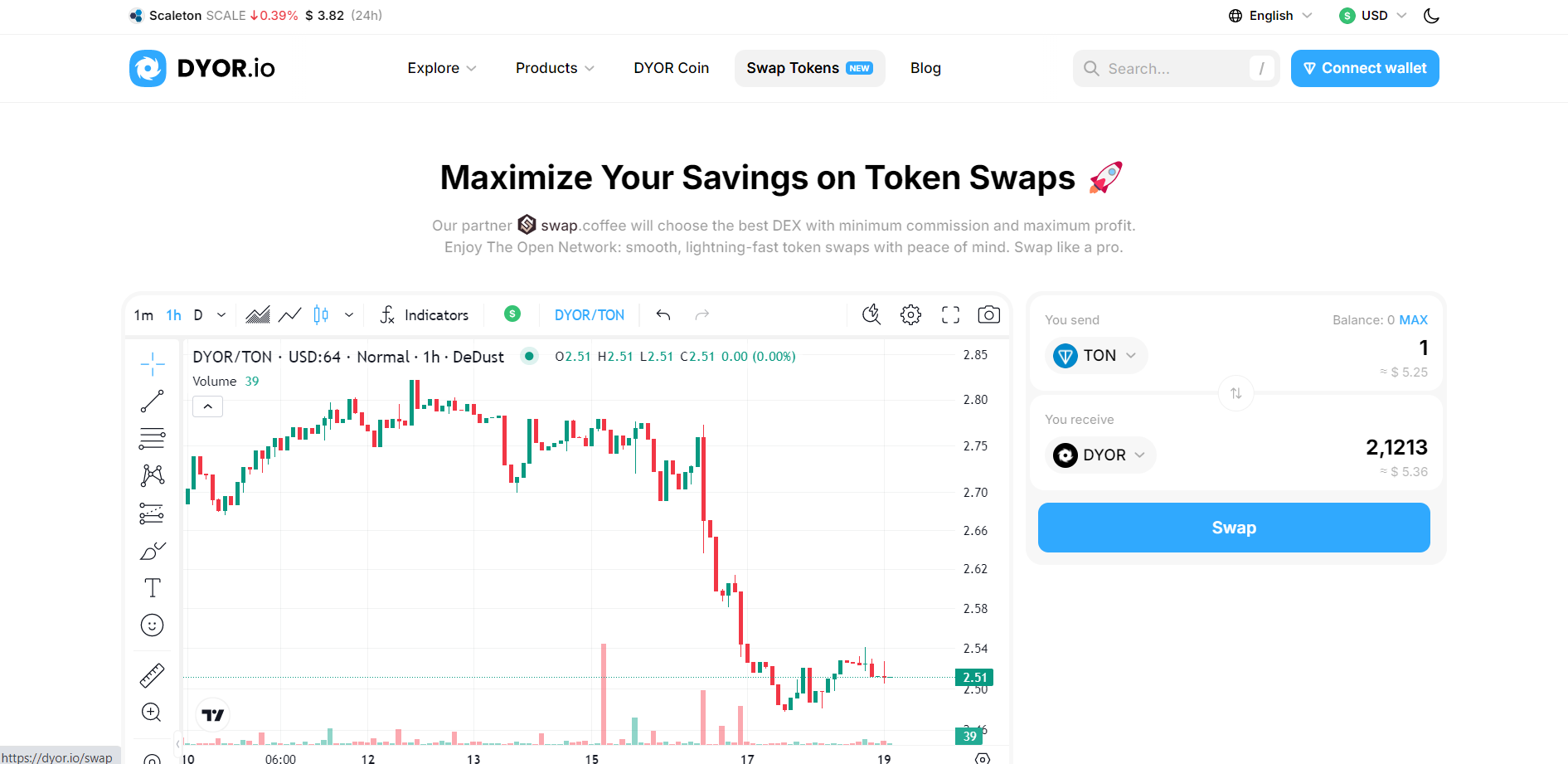

Swap Tokens on DYOR.io: Benefits and Features

For your convenience, DYOR.io has a dedicated Swap Tokens section where users can not only view token information but also make instant swaps directly on a separate page. This allows for easy and fast exchanges of any tokens supported by the TON ecosystem, while minimizing fees and providing the best rates for deals.

What Makes Token Swaps on DYOR.io Good?

- Instant swap

Forget about third-party platforms. Everything can be done right on the spot - token swaps happen in seconds, with no unnecessary redirects. Everything is automated, and you just need to click a few buttons.

- Low fees

Low fees are important to every trader. Our feature is specifically designed to minimize transaction costs so that you get the most value for your money.

- Favorable rates

Thanks to the integration with swap.coffee, we guarantee you the best exchange rates on the market. Your assets work to their fullest - traders get more for their trades.

- User-friendly interface

It’s now even easier. No need to dig through token cards - everything is organized on a separate page. Even if you’re a beginner, the swap process will be intuitive.

- Direct swap links

A new feature is the ability to share links to specific token swaps. Just copy the link from the address bar and send it to whoever needs it. This is convenient for personal use and for promotion in marketing or affiliate programs.

Practical Guide: How to Use Bridges and DEX for Maximum Benefit

Using bridges and decentralized exchanges is not just about convenience - it’s an opportunity to significantly expand the range of operations with assets and manage them most efficiently. Here are a few steps to help you make the most out of bridges in the TON ecosystem:

Step 1: Choosing the Right Bridge

Let’s start with the basics - you need to choose a bridge that suits your goals. Here are some factors to consider when selecting a bridge:

- Which blockchains are supported.

- Reliability and security: check if the bridge has verified smart contracts.

- Fees: study the fees charged for transactions.

By following these simple rules, you can minimize risks and costs when transferring assets.

Step 2: Connecting the Wallet and Performing the Swap

Chose a bridge? Great! Now you need to connect your wallet. Most bridges support popular solutions like MetaMask or TON Wallet, and connecting is fairly simple:

- Go to the bridge’s website.

- Connect your wallet to the platform.

- Specify the assets you want to transfer and select the network to send them to.

Then, the smart contract locks your assets in the source network and creates their equivalents in the target one. All of this happens automatically and very quickly.

Step 3: What to Do with Assets After the Transfer

Once your assets are successfully transferred, they are available in the target network. Here’s what you can do with them:

- Trading on DEX

Access trading on platforms like STON.fi, Uniswap, and others. This gives you the opportunity to work with a wide range of tokens under the best conditions. - Farming and staking

Use assets to participate in DeFi protocols and earn through staking or liquidity farming. This is a great way to increase the yield on your crypto assets. - Participating in token sales

Some projects are only available in certain ecosystems, and transferring assets to the right network can give you a chance to participate in new token sales or other investment opportunities.

Step 4: Using DEX Aggregators for Maximum Profit

To exchange tokens with minimal costs and the best rates, don’t forget about DEX aggregators. These platforms analyze data from various exchanges and help you find the most profitable conditions. What they offer:

- Optimal routes for token swaps.

- Minimal transaction fees.

- Reduced slippage for large trades.

Examples of aggregators supporting TON: STON.fi and other platforms where tokens obtained through bridges can be traded.

Risks and Security When Using Bridges

Although bridges and decentralized exchanges offer many opportunities for users, it’s important to remember the associated risks. To minimize the chances of losses or hacks, there are several key security aspects to consider:

Smart contract vulnerabilities

Smart contracts, which bridges rely on, may contain bugs or vulnerabilities that hackers can exploit. There have been cases in the past where smart contract hacks led to significant losses of funds. To minimize this risk:

- Use bridges and platforms that have undergone independent security audits.

- Keep an eye on updates and news about the projects to be aware of possible vulnerabilities.

- Be cautious when using new or lesser-known bridges and avoid transferring large amounts right away.

Oracle-related risks

Oracles play a key role in ensuring the connection between blockchains when using bridges. If an oracle transmits incorrect information or is attacked, this can lead to transaction failures or loss of funds. To reduce this risk:

- Choose bridges that use trusted and reliable oracle systems.

- Study how the oracle system works on your chosen bridge and make sure it’s secure.

Centralized elements in decentralized systems

While bridges are usually advertised as decentralized, sometimes they may have centralized elements, such as administrators or key network participants who have access to critical functions of the bridge. This creates a risk that attackers could gain control over the bridge’s management. To avoid such risks:

- Investigate how decentralized the architecture of your chosen bridge is.

- Look for multisig features, which require confirmation from multiple network participants to complete transactions.

Phishing and scams

Scammers often use phishing sites or fake links to steal users' funds. Fraudulent sites may imitate legitimate platforms, such as bridges or DEX, to steal wallet data or gain access to funds. To protect yourself:

- Only use verified and official websites.

- Always check the URL before entering wallet details.

- Don’t click suspicious links and check information on official sources.

Private key loss risks

When working with decentralized platforms, users are fully responsible for their private keys. Losing your private key or sharing it with third parties could lead to the loss of all funds in your wallet. To protect your assets:

- Store your private keys in a secure location (e.g., a hardware wallet or secure offline storage).

- Don’t share your keys with anyone and don’t store them in public places (e.g., cloud services).

Asset volatility

Transferring assets between networks via bridges can take some time. During this period, the price of assets may significantly change due to high volatility in the cryptocurrency market. To avoid unexpected losses:

- Pay attention to market conditions before starting a transaction.

- Use insurance or hedging mechanisms to protect against price fluctuations if the transaction amount is significant.