Beyond Staking: How WCPI Pools and STON.fi V2 Are Transforming DeFi

Your tokens can generate income without the need for active trading. Liquidity Pools (LP) offer a way to transform your assets into a productive tool: by adding liquidity, you enable seamless trading for others and earn a share of the fees in return.

In this article, you’ll learn about:

- How LP pools work and why they are beneficial.

- What makes WCPI Pools on STON.fi unique.

- How the STON.fi V2 update simplifies DeFi for TON users.

What Are LP Pools, and Why Do We Need Them?

Liquidity Pools (LP) are the foundation of decentralized exchanges (DEX). By adding your tokens to a shared pool, you provide liquidity and enable seamless trading for users.

Why It Matters:

- For Traders: Fast and reliable transactions, supported by consistent liquidity.

- For You: A share of transaction fees (e.g., 0.2% on every trade on STON.fi) and additional rewards through farming.

Lock Periods

Some pools require you to lock your assets for a set period, ensuring liquidity stability. In return, such pools often offer higher fees or bonuses.

Instead of sitting idle in your wallet, your tokens can work for you, generating profit through LP pools.

How Do LP Pools on STON.fi Work?

Adding liquidity to STON.fi pools is a straightforward process. Here’s how you can become a liquidity provider:

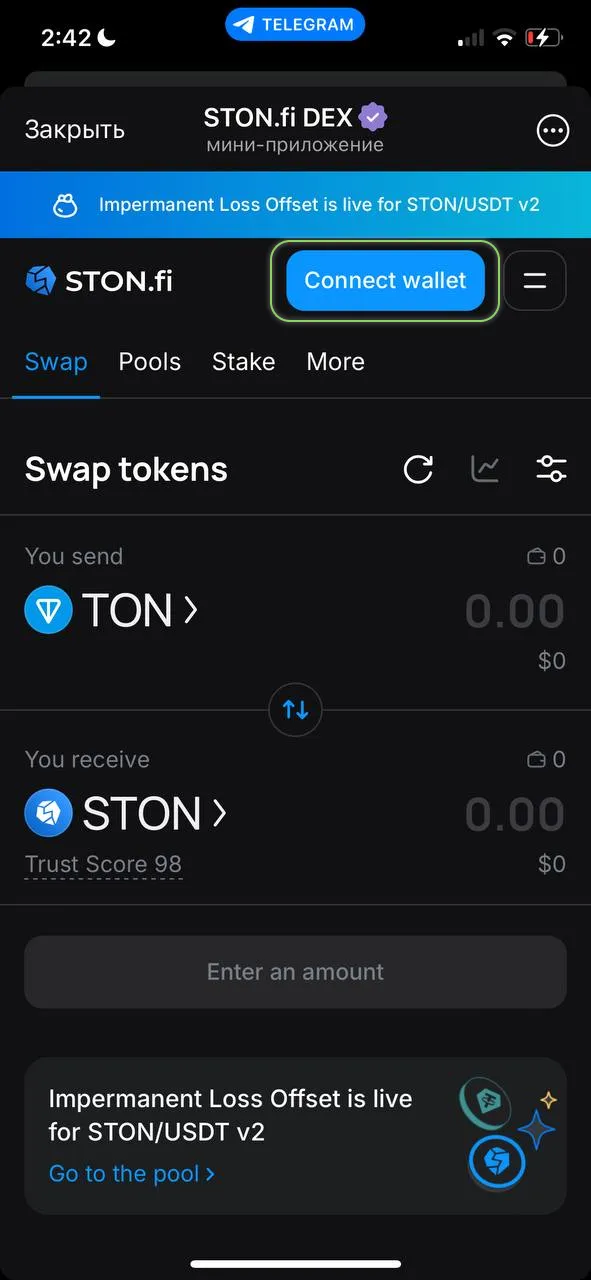

- Open the STON.fi mini-app through Telegram and click the "Connect wallet" button to link your wallet.

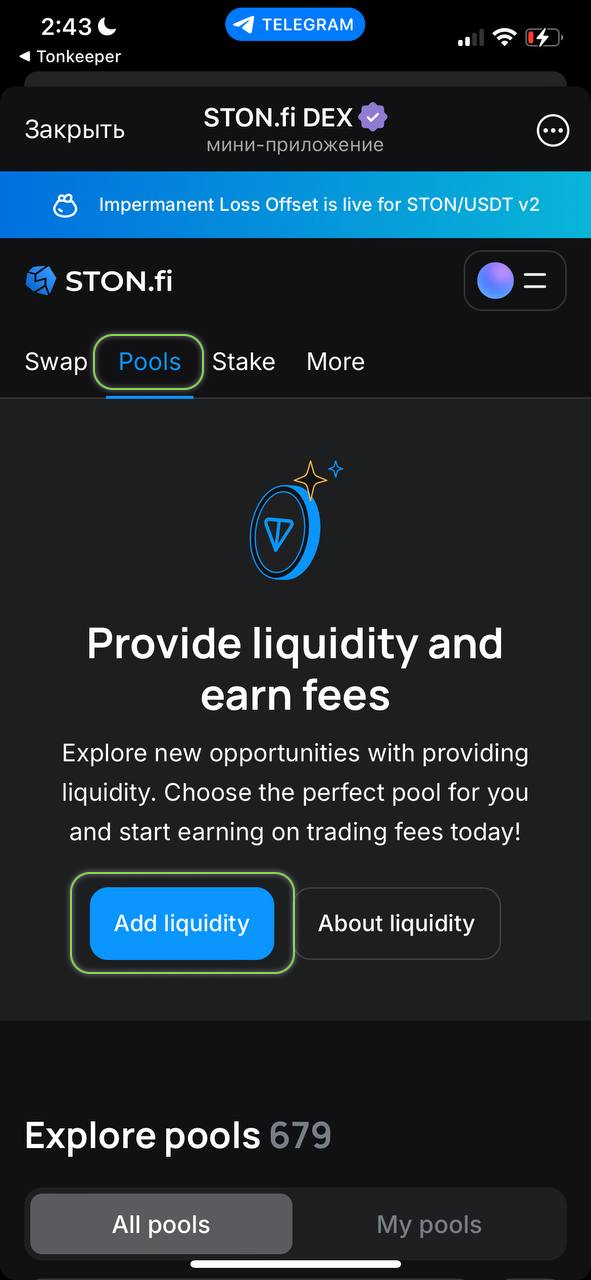

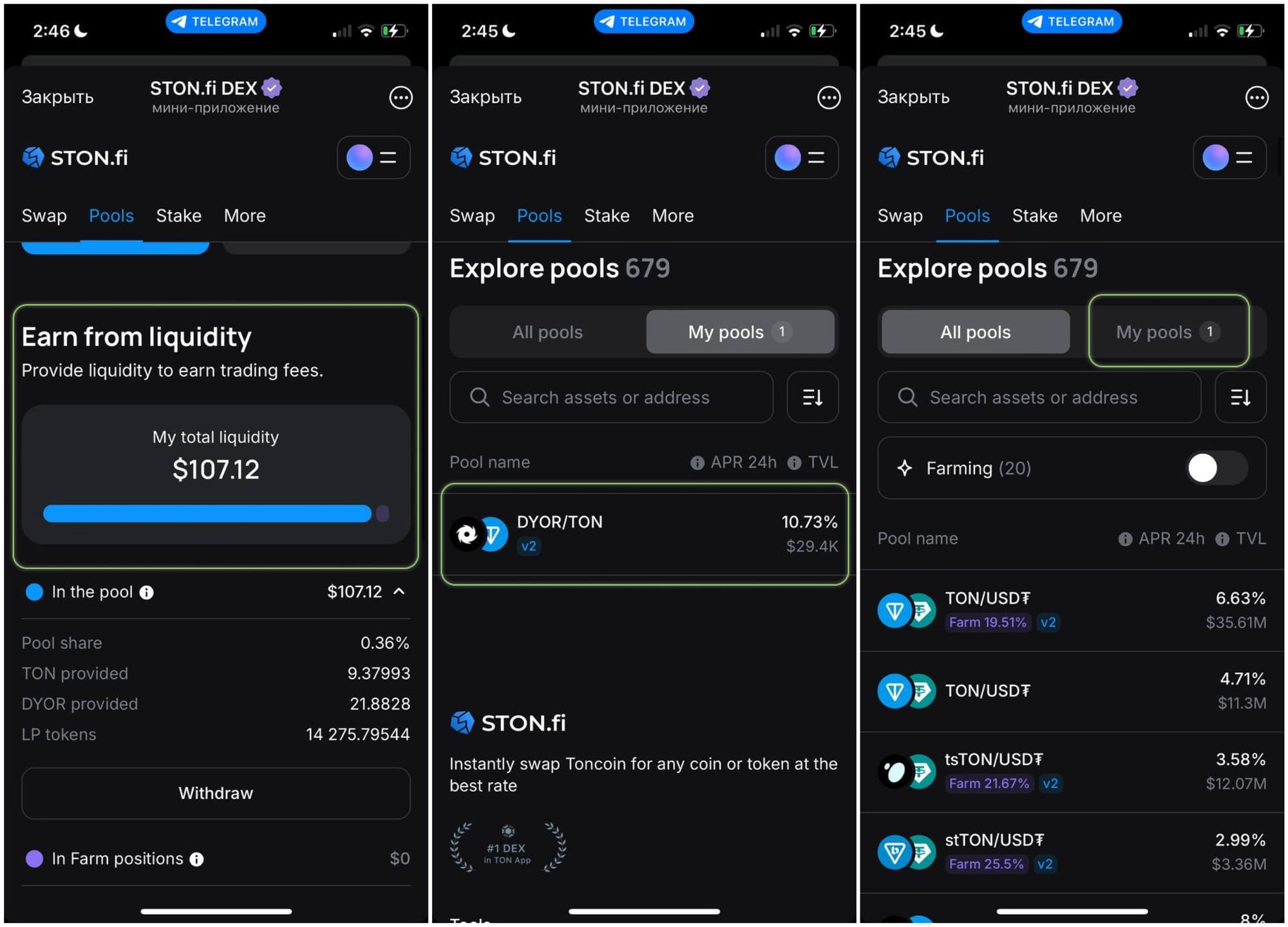

- In the app menu, select the "Pools" section. Here, you can view the available liquidity pools. To become a provider, add liquidity to a pool using the "Add liquidity" button.

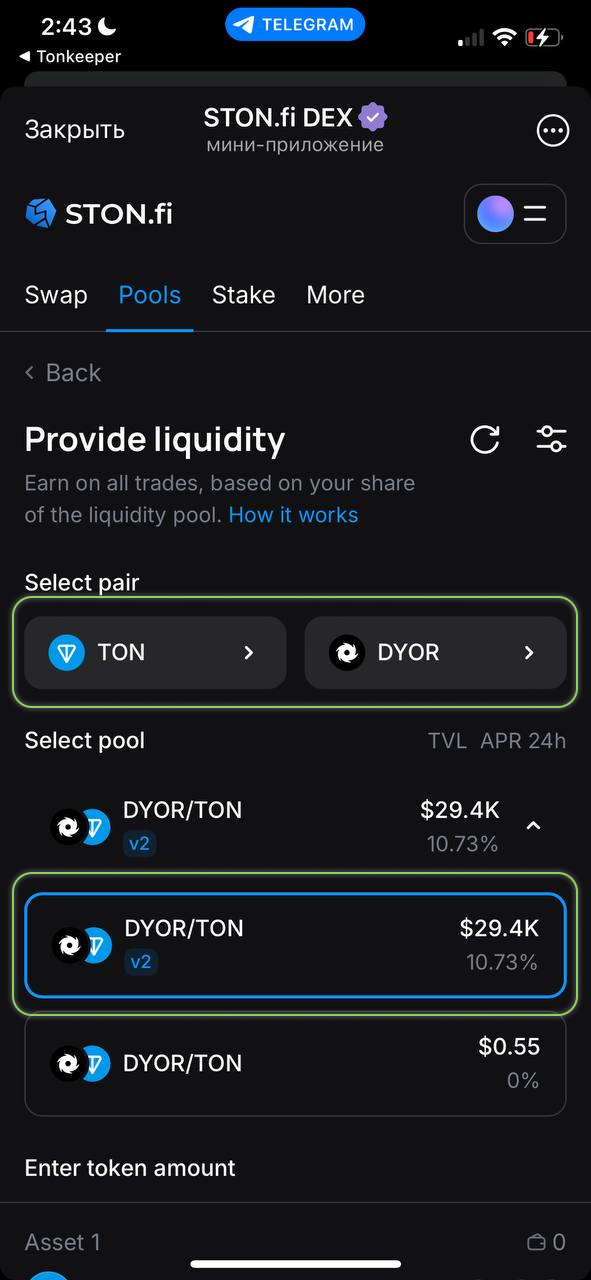

- You can use the search function or filters to find the pool you want to add liquidity to (e.g., DYOR/TON). TON is the default token, but you can choose another token to pair with it if the pool is active on STON.fi. Don’t forget to review the pool's liquidity, as STON.fi features both V1 and V2 pools. Most projects moved to V2 pools after the recent update.

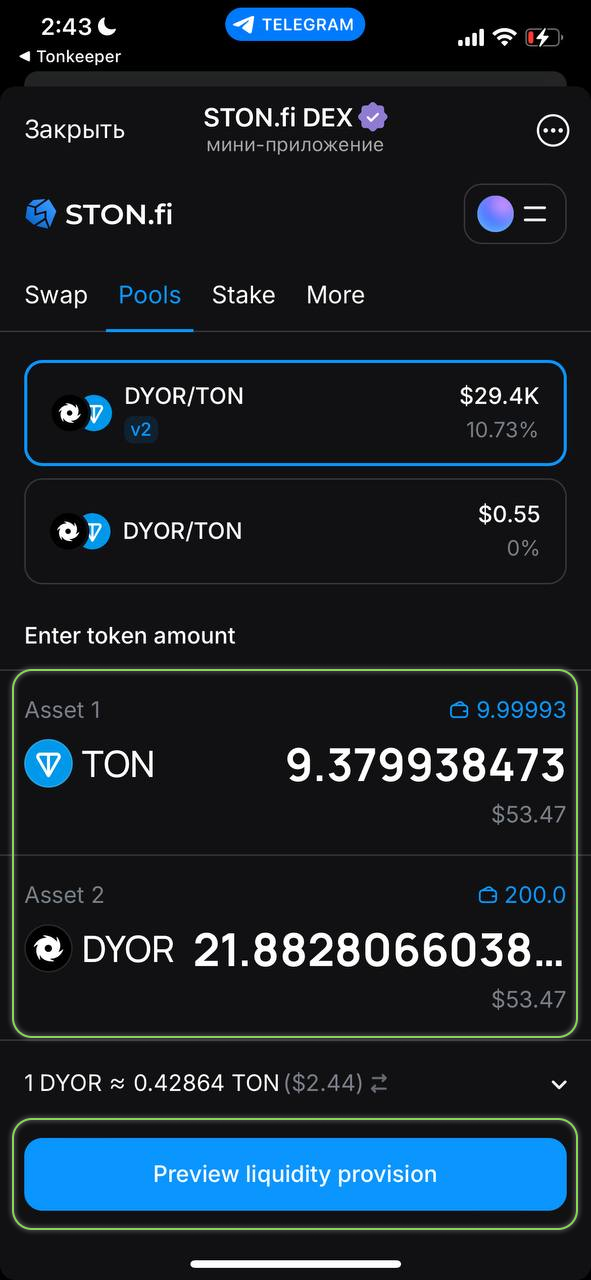

- Enter the amount of tokens you want to provide to the pool. Keep in mind that for standard pools, the token distribution will default to a 50/50 split. Click "Preview liquidity provision."

- Before adding liquidity, review key metrics:

- APR (Annual Percentage Rate): Your expected yearly yield.

- Pool Share: Your proportion of the pool.

- Minimum Received: The minimum amount you'll get upon withdrawal.

Click "Liquidity provision" and approve the transaction in your wallet.

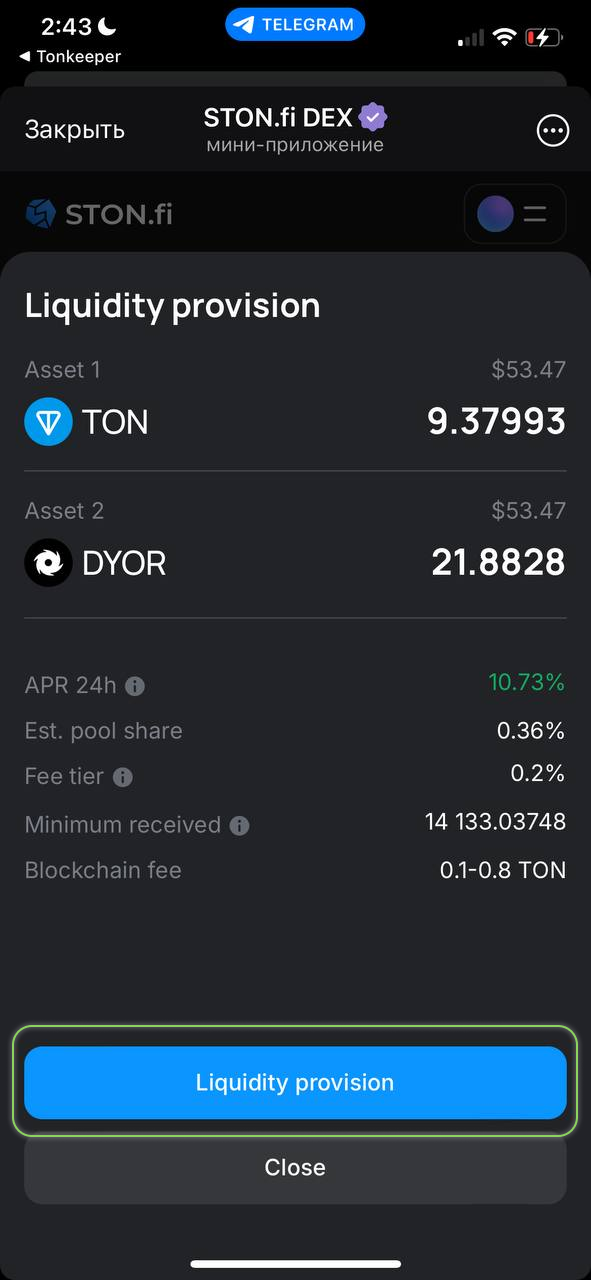

- After adding liquidity, go to the "My pools" section to monitor your position and earnings.

- To withdraw your tokens, open the "My pools" section, choose the pool, click "Withdraw," and set the amount to withdraw. Confirm the transaction in your wallet. Keep in mind that some pools may require a mandatory liquidity lock period (e.g., 30 days).

Risks

Liquidity Pools are a great way to make your assets work, but they come with risks. The primary challenge is impermanent loss. While the term may sound intimidating, understanding it simplifies everything.

Example: Let’s say you join the DYOR/TON pool, where DYOR currently trades at 0.442 TON. You contribute equal amounts of both tokens. If DYOR's price suddenly rises to 0.9 TON, the pool’s balance will adjust: you'll end up with fewer DYOR and more TON. When withdrawing, you’ll get more TON but fewer of the "appreciated" DYOR tokens.

WCPI Pools and the Ston.fi V2 Revolution

“Have you ever dreamt of a better version of yourself? Younger, more beautiful, more perfect.” It’s as if STON.fi injected itself with that substance and transformed into a new version. The V2 update isn’t just a fresh interface or a couple of new features – it’s a leap toward making DeFi more flexible and accessible.

The star of this transformation is WCPI Pools, rewriting the rules of liquidity management. These pools put users in full control, allowing them to customize liquidity settings to fit their needs. STON.fi V2 isn’t just keeping up with trends — it’s setting them.

What Are WCPI Pools?

WCPI (Weighted Constant Product Index) Pools take liquidity management to the next level. Unlike traditional pools with fixed 50/50 token ratios, WCPI Pools let you adjust asset weights.

Why it’s useful:

- Reducing risk: Adjustable weights allow you to minimize the impact of price volatility. For example, you can allocate 75% to a stable token and 25% to a more volatile asset.

- Diversifying assets: Include more than two tokens in a single pool to spread risk effectively.

- Controlling volatility: Customizable weights make your returns more stable and predictable.

- Maximizing earnings: Tailor the pool to your specific goals, whether you prefer steady returns or higher potential profits.

STON.fi V2: New Opportunities for TON Users

- User-Friendly at Every Step. The revamped interface simplifies farming, staking, and liquidity provisioning, making DeFi accessible to everyone. Even newcomers can grasp it in just minutes.

- Customization for Any Need. WCPI Pools offer precise risk and return management, paired with an intuitive interface that’s easy to use — even for those who’ve only just discovered DeFi.

Why This Matters for TON

STON.fi V2 with WCPI Pools demonstrates TON’s capability to deliver solutions that make liquidity management flexible, secure, and user-friendly. This attracts new users and positions TON as a strong competitor among blockchains.

Final Words

Liquidity Pools are about actively leveraging your tokens — earning a share of fees from every transaction. With innovations like WCPI Pools on STON.fi, liquidity management is now more flexible and secure: fewer risks, more control, and truly working assets.

Try the TON/DYOR pool to maximize the utility of our platform’s token. Add liquidity, earn income, and become part of the ecosystem.