After the Hype: What Happened to P2E Projects?

When Play-to-Earn (P2E) or Tap-to-Earn (T2E) surged into the crypto world, it seemed like a promising future with easy earnings: tap the screen, and coins pour in. These tapping apps quickly gained an army of fans, drawn in by the idea of nearly effortless income. But now, as the hype wave has waned, the question arises: is this the new crypto reality or just a temporary flash that’s about to fade?

Interestingly, ambitious T2E projects initially attracted not only investors but also crowds of users eager to try any novelty to earn easy tokens. However, this sharp rise in interest faced market realities, and many similar projects quickly underwent correction, leaving some disappointed and others satisfied. If you want to dive into the variety of these projects, check out our article on the top Tap-to-Earn games.

Analyzing the First Days After Listing

Each T2E project launched like a rocket upon listing but landed much less spectacularly. The first day – explosive volumes and price growth, then… serious ups and downs and declining interest. Let's take a closer look at this carousel.

Notcoin

The launch was so bright that, for a moment, it seemed like a new crypto king was in front of us. Market capitalization on the very first day soared to $710 million, users were buying up, and trading volumes were rising. But as soon as the first holders began to take profits, a logical “cooling off” followed. Still, Notcoin managed to retain part of its audience, stabilizing below the peak yet remaining significant.

DOGS

DOGS also made a strong first-day start, driving its capitalization to $630 million. Trading was active, interest was high, but it followed the same familiar pattern: a sharp rise, profit-taking, and the expected pullback. Large holders especially “helped” lower the price by joining the wave of sales and adding volatility.

Catizen

Catizen launched with a capitalization of $270 million within a day. The price shot up, but it didn’t last long – by the end of the day, the project began to lose some of its initial price. And again, the same story: short-term profit turned out to be more important to many.

Hamster Kombat

The start was powerful – although, considering the project’s wild popularity, the result wasn’t that impressive – with a capitalization exceeding $430 million, and trading was active. However, it was impossible to stay on the wave of success. Users eager to withdraw their money began “cashing out” by the end of the day, driving down the price and dimming early hopes of "easy" earnings.

X Empire

With more modest starting figures – a capitalization of about $30 million – X Empire showed a sharp rise and an equally quick decline. Despite the initial interest, trading volumes and capitalization failed to reach the levels of the others, and interest in the project quickly faded.

What Do We Have?

These projects made a splash initially, but rapid sell-offs quickly doused the excitement. Essentially, the first days after listing showed that T2E applications attract speculators, not long-term enthusiasts. The hype attracts a large audience but does not hold prices.

Current On-Chain Activity

Notcoin

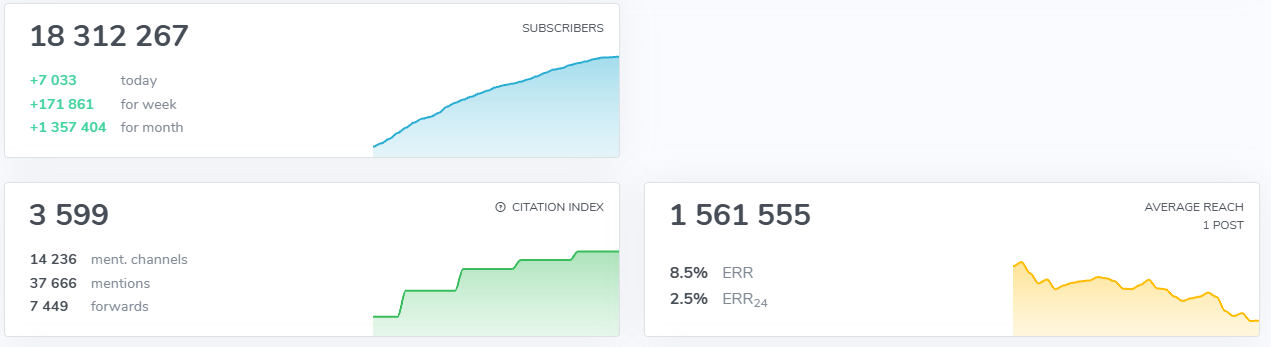

Despite the token price dropping to 0.0057 USD, Notcoin holds its ground: daily volumes in October range from $56 to $258 million. Yes, the price has dropped, but the audience remains – actively trading and, interestingly, continues to grow. The Telegram channel already has more than 18 million subscribers, with 1.35 million new ones added in the last month alone. Posts there get 1.5 million views, hinting at a very high level of engagement.

Large holders aren’t lagging behind either: the number of wallets with balances from $1,000 to $10,000+ has soared by 2011% in recent weeks. Large investors seem to see potential and are clearly not planning to let Notcoin slip from their portfolios.

To keep this interest, the Notcoin team isn’t sitting idle. A new ace is in play – Not Games. An ecosystem where the $NOT token becomes more than just a coin. Here, holders have access to exclusive drops and bonuses, and Gold and Platinum levels offer even more privileges. Not Games promises unique seasons, fresh characters, and a focus on the Telegram audience.

And that’s not all: soon, the team plans to launch a product to make drops easier for token holders. This move will not only add value for current holders but may also increase Notcoin's attractiveness as a project with forward-looking plans.

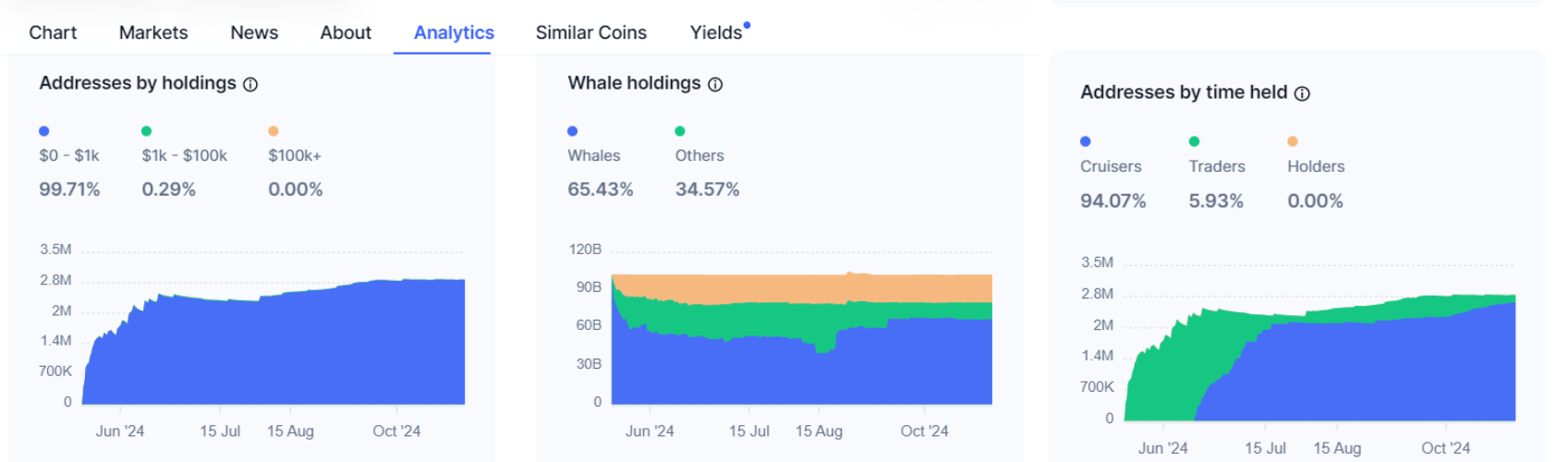

The whale share on the chart holds steady at around 65.43%, with minimal fluctuations. At the beginning of the period, there was some volatility, but closer to the end, whale positions seem to have strengthened. This “calm” could be a signal that major players are solidifying their positions, giving the project a buffer of resilience.

Initially, traders dominated the addresses, holding tokens briefly. But the summer-fall of 2024 brought changes: now 94.07% of holders are so-called cruisers, fans of long-term holding. This trend points to growing trust in the project and a shift in focus from short-term profits to a strategic holding of the token.

DOGS

DOGS shows similar activity, maintaining volumes at no less than $50 million USD and sometimes reaching $240 million (October data), which speaks to the interest of traders, even with a weakened price.

Since its launch, DOGS has gathered a multimillion community – currently, the official Telegram channel has over 15.5 million subscribers. Despite impressive numbers, the project hasn’t avoided audience loss: in the last month, the channel lost about 1.16 million subscribers, indicating reduced user interest. Nevertheless, DOGS continues to show high reach: each post collects an average of 1.9 million views, and promotional messages attract more than 614,000 users within 24 hours. These figures show that DOGS remains a notable project on the crypto scene, even with declining engagement.

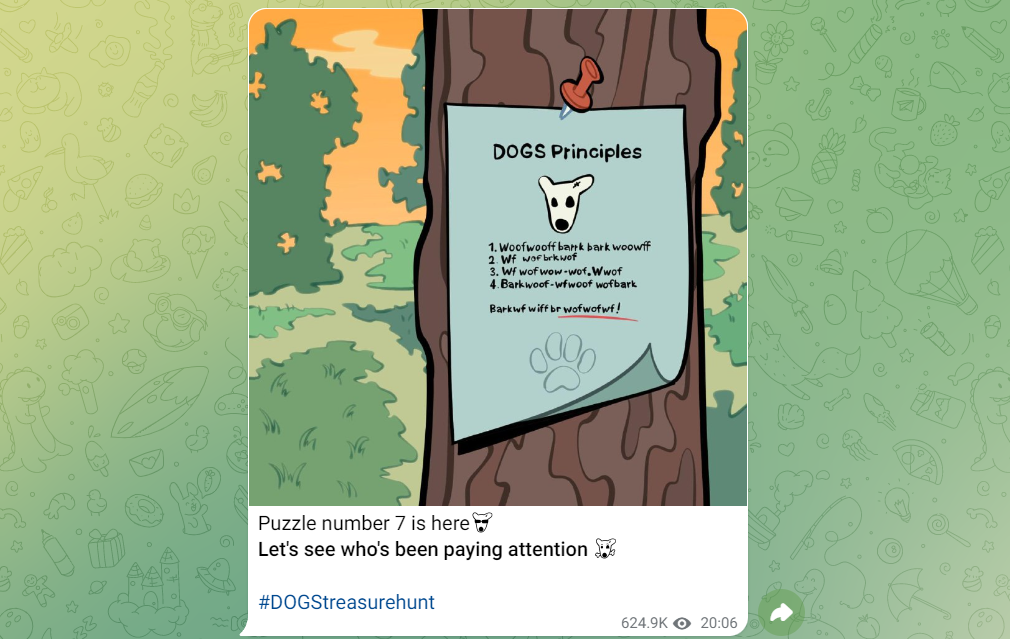

To keep the audience interested, the project team regularly organizes various promotions and interactive events. One such event was the "DOGS Treasure Hunt" – a quest where users solved puzzles to gain access to a wallet with 13 million DOGS. This quest attracted many participants, fueling activity in the community and creating a sense of belonging to a big project.

Another significant event was the recent token burn during the "DOGS & NOT Burn Event." More than 4.7 billion DOGS worth $4 million were burned, supporting tokenomics by reducing the number of available tokens and creating conditions for an increase in their value. These regular events allow DOGS to maintain an active audience despite the general trend of declining interest.

At the beginning of the observed period, whales held a solid 75% of the total volume, but they gradually started selling off, slightly reducing their influence. Probably, some large holders decided to fix profits or reduce risks. However, after a slight correction, the situation leveled off, and the whale share stabilized – a sign that the remaining major players are set on long-term holding.

Initially, DOGS attracted mainly traders – their addresses made up the overwhelming majority. But October brought an interesting twist: the share of “cruisers” (long-term holders) quickly rose from 0% to almost 97.75%. This shift hints at growing trust in the project and that more DOGS holders are choosing a long-term strategy.

Catizen

Catizen (CATI) – trading volumes in October ranged from $31 to $167 million, significantly below the initial values.

To keep focus on them, Catizen regularly introduces updates. Over 8 million subscribers follow them on Telegram, and while audience growth has slowed a bit, developers are doing their best to improve the platform.

A recent feature is the beta version of Catizen Mini Game Center. This is a full gaming hub where users can try new games and earn rewards – from in-game drops to referral bonuses. $CATI holders get some nice perks: a 30% discount on in-game purchases, participation in the launchpool for earnings, and transaction fee bonuses in the Vanilla trading bot. All this makes $CATI not just a governance token but a tool with real benefits.

The share of whales in $CATI remained unchanged at 92.38% throughout the period. This stability clearly shows that major holders have chosen a long-term holding strategy and are not planning to exit quickly.

Initially, the majority of holders were traders, but as Catizen gained weight, more holders shifted to “cruisers.” By the end of the period, their share had grown to 83.12%. This change points to sustained interest in the project and a choice of long-term strategy, which adds stability to CATI.

Hamster Kombat

The trading volume of $HMSTR has decreased to $18 million over the last 24 hours, reflecting the waning interest in the token, especially against its sharp price drop. Nonetheless, some activity is still observed.

Hamster Kombat once launched loudly: after the September airdrop, the number of users soared to 110 million. But after a month, half of them had seemingly vanished, leaving only 43 million active users. It seems that after the initial boom, the project struggled to keep its users.

On paper, Hamster Kombat looked like a prime example of a T2E project with a focus on interactivity and engagement. But in practice – internal conflicts, a lack of major updates, and modest income after listing quickly dampened enthusiasm.

Let’s also add unmet promises: the second season, which was planned to launch by the end of October, is still "somewhere out there." The last Telegram post on October 31 congratulated players on Halloween and announced future updates, such as the integration of external payment systems and an expanded game library. But when exactly – remains unclear, causing some dissatisfaction among the community.

Thus, Hamster Kombat faced a harsh reality: a loud start is one thing, but sustained interest is another. Now the project faces a challenging task: to bring back players and show that there’s a reason to stay.

The chart shows that whales continue to hold onto $HMSTR strongly – their share remains stable around 88.5%, with no significant changes observed. This suggests that major holders are in no hurry to part with the tokens, demonstrating confidence in the project. In their portfolios, Hamster Kombat occupies a solid place, and this position remains unchanged for now.

Initially, the project attracted a lot of traders who held tokens for less than a month. But closer to the end of October, the situation changed: now the “cruisers” who decided to keep $HMSTR for a longer term dominate the scene. This hints at a gradual shift from short-term speculation to long-term holding.

X Empire

With a trading volume of just $20 million, X Empire shows weak activity, especially considering that it’s been just over a week since its listing. User interest is clearly fading – unsurprisingly, given the small market cap and rapid exhaustion of initial hype.

Initially, X Empire attracted the crypto community’s attention with its ambitious approach: focusing on developing applications for Telegram users gave the project a solid start. In the last month, the project channel grew to 21 million subscribers, although there were outflows here too – likely due to volatile interest in crypto projects and an unstable market.

Nevertheless, the X Empire team is actively developing a line of unique applications: Feed, Langs, and Sleep, tailored to the daily needs of the audience. Feed, for example, promises to become a personalized platform for reading Telegram channels, with the ability to search and structure content by interests. Moreover, the team has plans to add exclusive features available only to $X token holders – intended to create incentives for buying and holding the token within the ecosystem.

Reasons for Increased “Cruisers” Share in Holding Behavior

- Decline in Trading Activity: When a project gradually loses hype, the frequency of short trades drops, and more users simply leave tokens alone, waiting for the right moment. This increases the share of “cruisers” – participants who prefer holding over active trading.

- Token Price Decline: A drop in price after listing or airdrop turns traders into patient holders. They decide not to sell at a loss and wait for the price to rise. Thus, over time, they also join the cruisers’ ranks.

- Token Freezing: Some projects offer attractive staking conditions – “freeze tokens and get bonuses.” Naturally, users agree, increasing the share of long-term holders.

- Gradual Disappointment: Paradoxically, some cruisers are those who have already given up on the project and left tokens in their wallets without trading them. These are passive holders who have essentially forgotten about the project but still fall into the long-term holder category.

- Holding Rewards: Some projects entice users with bonuses and discounts for long-term holders. A small perk, but nice – and participants prefer not to sell assets.

- Loyalty Programs or Exclusive Offers: By launching loyalty programs, projects can give token holders access to closed features, games, or early releases. Conditions require minimal holding time, so users become “cruisers,” receiving perks for loyalty.

Typically, the rise in cruisers results from a combination of factors: reduced trading activity, hope for price recovery, desire to participate in loyalty programs – all of which creates an army of long-term holders.

On Rewards

The emergence of Notcoin was the starting point for the entire Tap-to-Earn wave. Its explosive success at the start showed everyone that the simplicity of the T2E mechanic and easy earnings through Telegram were not fiction but a real opportunity. As a pioneer in its field, Notcoin attracted crowds of users and set a high bar for all who tried to follow it. On the wave of its success came Hamster Kombat, Dogs, Catizen, and other projects that tried to adapt Notcoin's format to their ideas.

Earnings became a decisive factor for every T2E project. Notcoin, being the trailblazer, provided participants with substantial income, proving that Tap-to-Earn could be profitable. This success pushed followers to attempt to replicate its model, but not all managed to meet the audience's expectations.

Hamster Kombat quickly disappointed players: the average income did not exceed $20, and many users turned away, seeing no reason to stay. X Empire fared even worse: even the most active players could not earn more than $10, and those who invested went into the red – resulting in a sharp audience outflow. Catizen tried to stand out by offering donations for significant rewards, leading to a 3x for some, but others who couldn’t or didn’t want to invest remained unsatisfied.

Against this backdrop, Dogs showed more stability: active players could earn from $50 and up, which kept interest in the project longer.

In the end, differences in earnings and the ability to meet user expectations became the factors that determined which of these projects could retain their audience and which quickly lost it at the start.

You can always check for coins received as rewards for participating in projects at your wallet address in our airdrop checker. We update information on events and add new projects to the checker from time to time. Stay tuned.